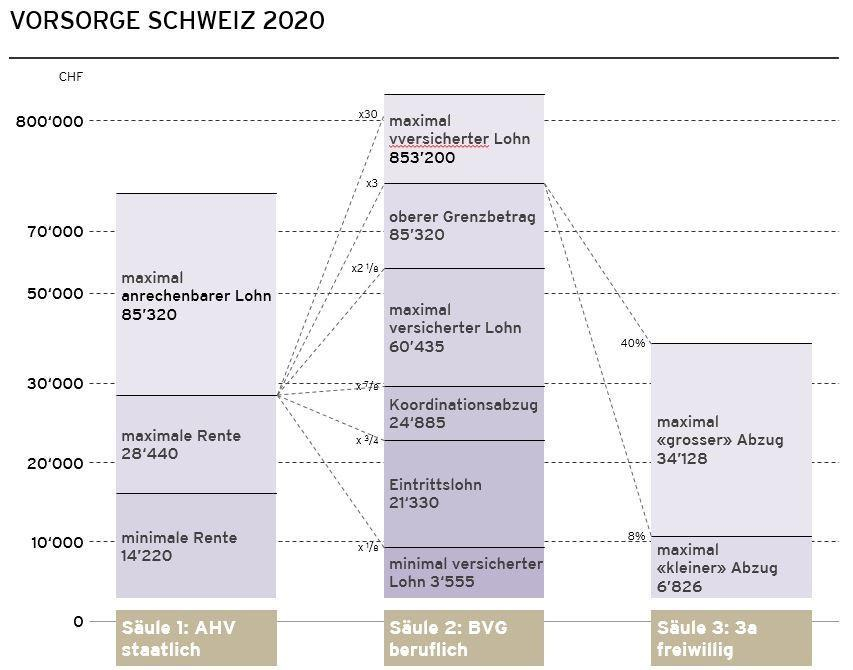

Social Insurances - Contributions and Benefits 2020

Do you have any questions about your occupational pension plan or are there any uncertainties regarding wage components subject to social insurance contributions? We will be happy to work with you to find a solution tailored to your needs.

Do you have any questions about your occupational pension plan or are there any uncertainties regarding wage components subject to social insurance contributions? Are you considering adjusting your accident insurance or introducing daily sickness benefit insurance? We will be happy to work with you to find a solution tailored to your needs.

In the referendum of 19 May 2019, the bill "Tax reform and AHV financing (STAF)" was adopted. As a result, the AHV contribution rates will be increased from 8.4 % to 8.7 % by 2020. The AHV/IV/EO contribution rate will therefore be 10.55 % from 2020, i.e. 5.275 % per employer and employee.

You can find details on the contributions of the 1st + 2nd pillars in our Social Insurance Factsheet 2020 .