What to expect from us

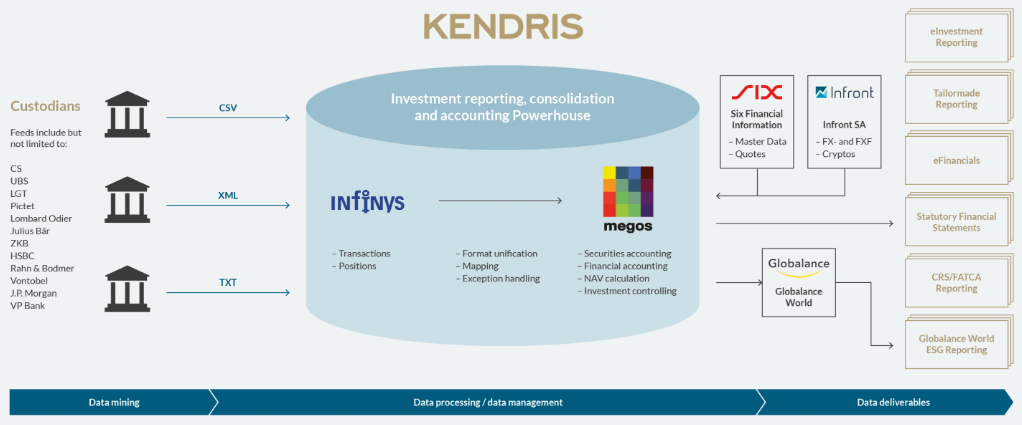

The manual procurement and recording of a securities transaction takes up to five minutes depending on the transaction type. Banks differ in both the format and the quality of the data delivered. Also, if custody accounts are held at several financial institutions, consolidation of this information is usually a challenge and often involves a lot of manual work.

We provide you with a solution that digitally automates the entire accounting and consolidation of securities while adhering to high security standards. By outsourcing your securities accounting, you gain process security and high efficiency that will ultimately be reflected in your budget. Scalability and the ability to generate more reports with accounting data give you additional flexibility, also for tomorrow’s needs.

Your powerhouse in accounting, consolidation and investment reporting

The customisable securities accounting solution streamlines processes and reduces the risk of errors or inconsistencies. By automating many of the manual tasks involved in handling, testing, or consolidating securities transactions, time and efficiency gains can be achieved.

More than a tool – a holistic approach developed and supported by experienced professionals:

Our tailor-made investment reporting gives you access to your securities portfolios anytime, from anywhere. Customisable dashboards and extensive analytics tools allow you to quickly and easily access the information you want, enabling you to make informed decisions.

Our accounting services are rounded off by optional preparation of financial accounting and any annual accounts. The CRS/FATCA reporting that has become mandatory for many can also be taken on for you in a highly efficient way.

What sets us apart

Greater efficiency via direct interfaces

Automation significantly increases efficiency by reducing the time and resources required to complete each transaction. By connecting various banks via API, the transactions and positions of your custody account can be loaded into the accounting system at any time, at the touch of a button. The number of banks is constantly expanding, and if they are not yet listed, we would be happy to check the connectivity.

Increase productivity and quality through automation

Organisations can streamline processes and reduce errors by automating manual and routine tasks, resulting in higher productivity, better quality and lower costs. In addition, larger transaction volumes can be processed faster, resulting in economies of scale and additional savings.

Modular scaling using additional services

Our services are modular and each configuration can be tailored to you. Thus, aggregated booking files and inventory lists can also be made available if necessary, for example if NAVs must be calculated for funds on the basis of securities accounting and this component should remain in-house. If necessary, we will support you with additional expertise and reporting in the areas of financial accounting, taxation and legislation.

Personal and without obligation – get in touch

Investment Reporting and Securities Accounting

Find out moreLatest news & insights

Employee participation: Why start-ups should read this guide