Four Years of the Automatic Exchange of Information in Switzerland

Switzerland has implemented the global standard (CRS) on the automatic exchange of information (AEoI) in 2017. The volume of the exchanged financial accounts and the number of partner states has grown steadily to date. What was new to everyone four years ago, to FIs and their clients, has now become the norm.

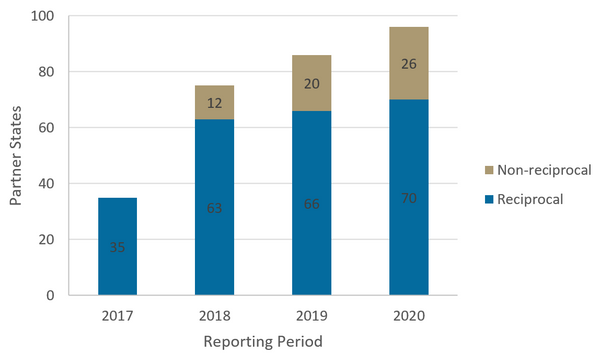

The Swiss Federal Tax Administration (FTA) has recently published figures which illustrate the high volume of the automatic data exchange in its fourth year. In this year's reporting season, during which financial data concerning the year 2020 was exchanged, the AEoI involved a total of 96 countries. Antigua and Barbuda, Azerbaijan, Dominica, Ghana, Lebanon, Macau, Pakistan, Qatar, Samoa and Vanuatu were added to the existing list of 86 countries. Switzerland received but did not provide data to 26 of those countries, either because they did (not yet) meet the international requirements on confidentiality and data security or because they are so called "permanent non-reciprocal jurisdictions" which means that that they chose not to receive any data. Please note that the national list of all CRS partner states of Switzerland is regularly updated and has priority over the OECD's list. The chart below illustrates how Switzerland's exchange network has grown over the last four years.

Currently, around 8'500 reporting financial institutions (banks, trusts, insurers, etc.) are registered with the FTA. These institutions are collecting data on financial accounts held and submit it to the FTA on an annual basis. In 2021, the FTA sent information on around 3.3 million financial accounts to the partner states and received information on approximately 2.1 million financial accounts from them.

All these figures show, that the fact that data on financial accounts is being exchanged has become the norm for Swiss financial institutions (at least for most of them) but also for their clients – respectively their account holders for CRS purposes. However, some financial institutions may face new challenges due to the revised CRS guidance , which amends the reporting and due diligence requirements for the 2021 reporting period – we have dedicated a webinar to this topic and are hosting another one on 25 October 2021 . Henceforth, even more persons will be considered as account holders and will consequently have to be identified and reported, especially in relation to FI trusts and foundations. The number of reported accounts should thus continue to increase.

Please do not hesitate to get in touch with our CRS experts if you have any questions about CRS reporting. The AEoI services we provide include advice, classification, due diligence and reporting – helping you to stay on top of your obligations.